The 2021 budget emphasises growth and development, in an attempt to lift India out of a growth slump while also ensuring the government has resources available to combat the Coronavirus pandemic. Sitharaman introduced several changes to the taxation process, including the scrapping of income tax for senior citizens and removal of double taxation for NRIs, amongst other measures. While a new Agriculture, Infrastructure and Development Cess was announced on numerous items such as gold, silver, alcoholic beverages, palm oil, apples, petrol, and diesel, the final consumer price of the goods will remain unchanged. This is because the corresponding customs and excise duties on the same products have been reduced. Other important features of the budget include the setting up of seven mega textile farms and an increase in Foregin Direct Investment (FDI) from 49% to 74%.

The Finance Minister in her budget speech also announced that two public sector companies and one insurance company would be subjected to strategic divestment. In the sectors classified as strategic there will be a lesser number of Public Sector Enterprises (PSEs). The government has budgeted Rs. 1.75 Lakh crore via stake sale in PSEs and financial institutions. The divestment target for fiscal year 2021-22 has been revised from the previous year’s target of Rs.2.10 Lakh crore. Central Public Sector Enterprises (CPSEs) in all sectors apart from some in atomic energy, space and defence; transport and telecommunications; power, petroleum, coal and other minerals; and banking, insurance and financial services will be privatised. In 2021-22, Bharat Petroleum Corp Ltd, Air India, Shipping Corporation of India, Container Corporation of India, IDBI Bank, Bharat Earth Movers Ltd, and Pawan Hans will be privatised. Additionally, apart from IDBI there will be privatisation of two more Public Sector Banks (PSBs) and one General Insurance company. Such a move would require legislative amendments and it is expected that legislative amendments to execute the above and to launch the Initial Public Offering (IPO) of Life Insurance Corporation(LIC) would take place in the ongoing session of the Parliament. This current divestment strategy is aimed at creating an investment ecosystem for the private sector by minimising the presence of CPSEs.

As a relief to the startup ecosystem, the Finance Minister has announced that the Capital Gains exemption for investments would be exempted for one more year till 31st March, 2022. This comes at a time when most of the startups have been struggling to survive amidst the pandemic. This measure is aimed not only at incentivising the startups but also at encouraging the setting up of new ones.

As the border stand-off with China continues in Eastern Ladakh, the Finance Minister announced a roughly 19% increase in the capital budget for the forces in 2021-22. However, the overall defence budget only increased by 1.5% from Rs 4.71 lakh crore in 2020-21 to Rs 4.78 lakh crore in 2021-22. China’s official defence budget in comparison, stands at $179 billion, roughly three times that of India’s (around 1.15% of its GDP).

Furthermore, the Department of Space has been allocated Rs. 13,949 crore out of which Rs. 700 crore has been earmarked for the New Space India Limited (NSIL).

The NSIL is set to execute the PSLV-CS51 launch carrying Brazil’s Amazonia satellite along with other smaller Indian satellites.

Another important highlight from Monday’s announcement was that all states that have upcoming Assembly elections- Kerala, Tamil Nadu, West Bengal and Assam have received a massive infrastructure boost in the form of spending on highway road expansion. The construction of Madurai-Kollam corridor and Chittor-Thatchur corridor is set to begin in 2022.

About 675 km of highway work in West Bengal has been planned at a cost of Rs 25,000 crore including the upgrading of existing roads in Kolkata and Siliguri.

Apart from an infrastructure boost, the Finance Minister also announced a programme to promote seaweed farming in Tamil Nadu, and a special welfare scheme for tea workers in both Assam and West Bengal. The government also announced an allocation of Rs. 3,726 crores for the first digital census.

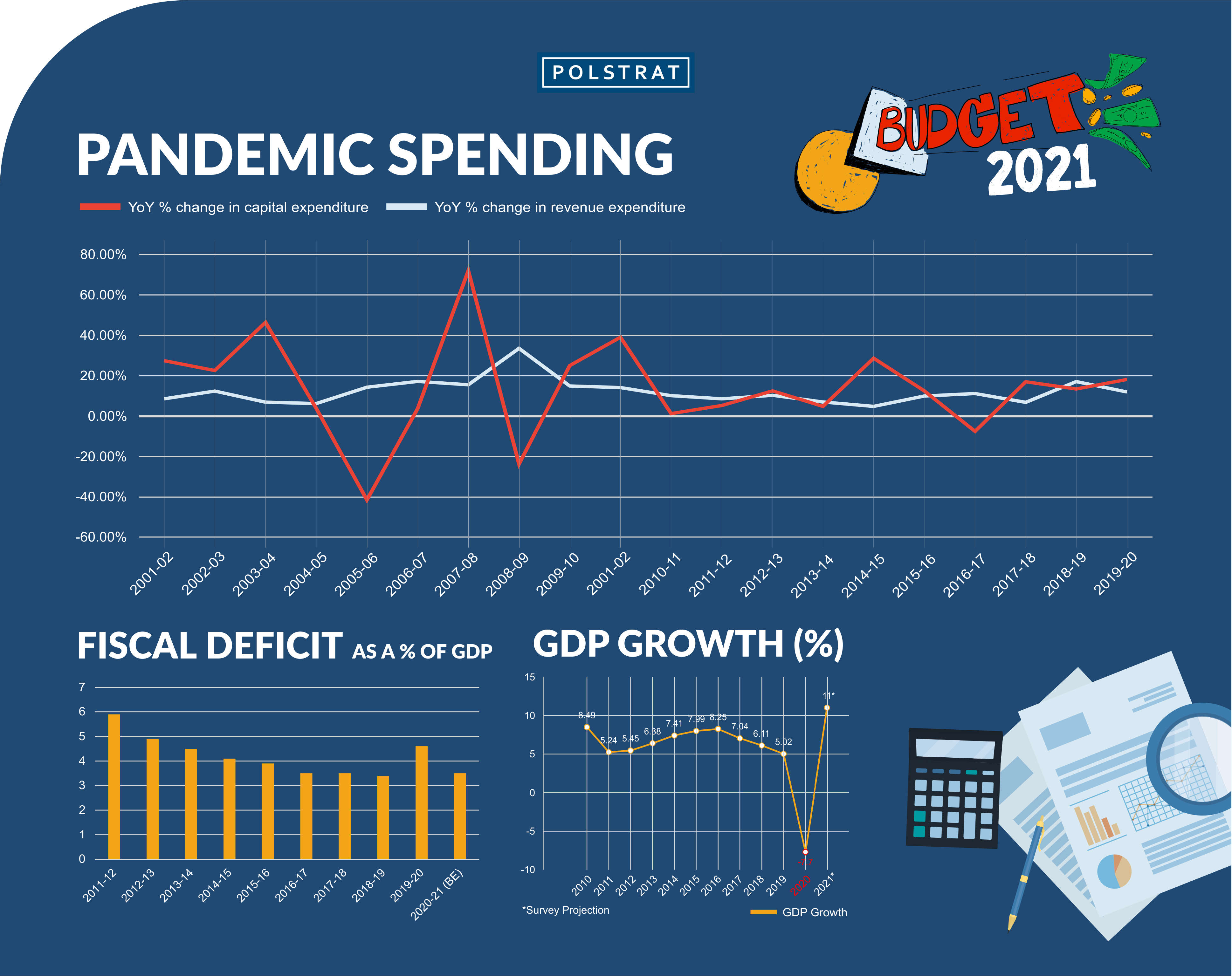

WILL BUDGET 2021 EASE THE FINANCIAL BURDEN OF COVID-19?

Despite the Finance Minister announcing that one of the six pillars of Atmanirbhar Bharat is health and wellness, the actual increase in money being allocated to the Ministry of Health and Family Welfare is a modest 7 per cent. As the country is dealing with the financial ramifications of the Coronavirus pandemic, and access to healthcare is needed more than ever before, the provision for Ayushman Bharat Yojna or the Pradhan Mantri Jan Arogya Yojana, remains unchanged at Rs 6,400 crore. However, the allocation for the Ministry of AYUSH (Ayurveda, Yoga & Naturopathy, Unani, Siddha and Homoeopathy) has been increased by 39%.

Additionally, Sitharam also announced the allocation of Rs. 35,000 crore for the COVID-19 vaccination programme, which would cover around 68.6 crore people (Rs. 255 per dose) in the financial year 2021-22. Under the pillar of Health and Wellness, the Finance Minister also announced a new centrally sponsored scheme- the Pradhan Mantri Atmanirbhar Swasth Bharat Yojana- to strengthen the healthcare system in the country. This will include the setting up of urban health and wellness centres, setting up integrated public health labs in all districts, among other measures. Roughly Rs. 64,180 crores has been allocated under the scheme for the upcoming six years (around Rs. 10,000 crore yearly), however, no timeline for when this money will be allocated has yet been shared.

WHAT DID BUDGET 2021 MISS?

Investments into the Information Technology (IT) sector received almost no attention in the budget. During the pandemic, despite the lay-offs, advancements in the IT sector has helped a fair section of people keep their jobs with the ‘Work From Home’ concept taking over. The IT sector is one of the biggest services export contributors in the country, however, no policies were announced to boost the future of companies in the IT sector.

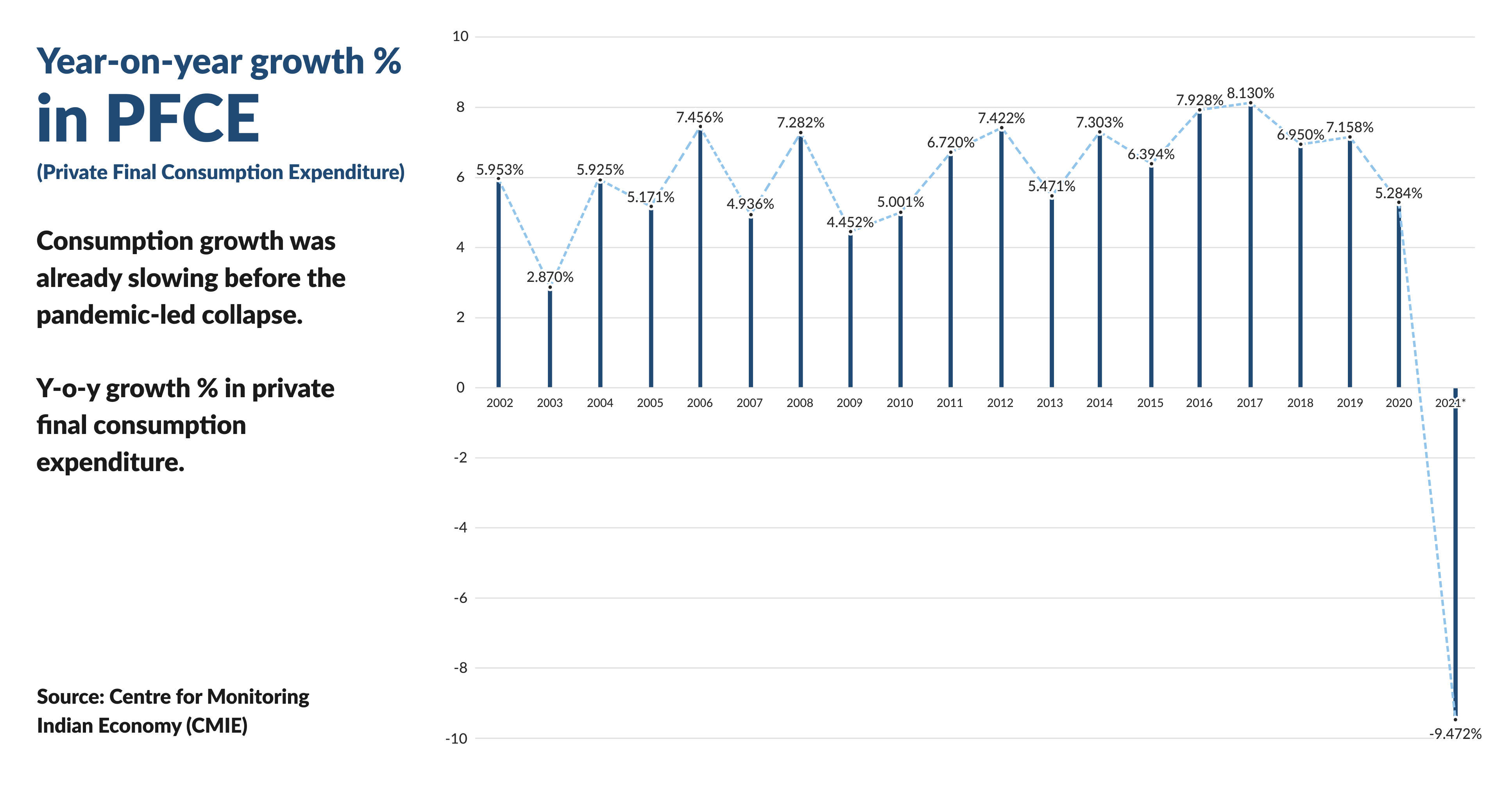

The income tax structure remains unchanged this year which is bound to irk the salaried middle class of the country. The Covid-19 pandemic and the subsequent salary cut has reduced the spending tendency especially of the salaried middle class. It was expected that the government would offer tax relief so as to increase spending . However, the tax structure remains unchanged. This can be attributed to the fact that the tax collections have drastically reduced in 2021-21 owing to the pandemic and a further cut might create an undesired increase in saving rather than spending.

Additionally, as thousands of farmers continue protesting across the country against the new agriculture laws announced by the central government, no major announcements were made to address the ongoing unrest. While Sitharaman announced an increase in agricultural credit target, no initiatives were announced to boost rural consumption. In fact, the budget estimate for expenditure on the rural jobs scheme was lowered from 1.1 trillion in 2021 to 730 billion in 2022.

BUDGET IN REWIND: MAIN HIGHLIGHTS OF THE 2020 BUDGET

Last year’s budget, highly anticipated by people as well as the economy, was struggling with weak economic growth, a slower tax collection and low business confidence. The budget focused on three major parts: Aspirational India, economic development and caring society. Some of the main relief policies and incentives appreciated by various sectors in the last budget were the complete tax exemption on income from all investments, the new education policy, rental sector and housing reforms, zero budget farming, pension for informal sector workers, new taxation policy and a capital boost for banks. Through the 2020 budget, the government aimed to ease investments and boost infrastructure growth in the country by announcing the creation of many more airports and highways.

Farmers and agricultural groups, however, expressed disappointment from the previous budget as there was no increase in the payouts to farmers under the PM Kisan scheme. Additionally, funds for the Food Corporation of India (FCI) which handles the Public Distribution System (PDS) and fertilizers subsidies were also slashed.

Many analysts and commentators were also disappointed that no specific relief measures were announced to generate jobs which had been a major economic concern in the country.