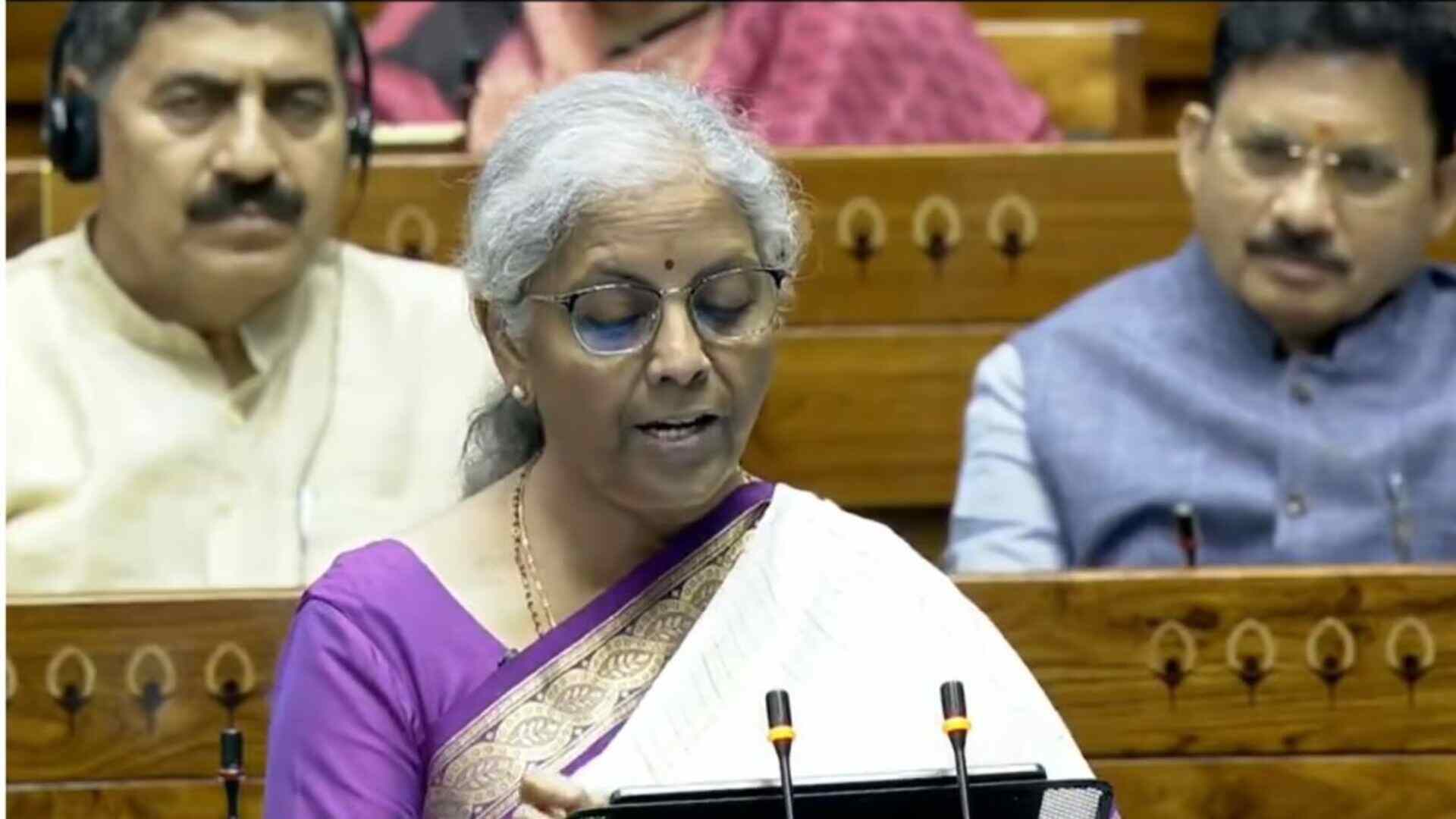

On July 23, Finance Minister Nirmala Sitharaman made a landmark announcement in the Union Budget 2024: the abolition of angel tax for all types of investors in India.

Sitharaman’s decision to remove the angel tax is a significant step for Indian startups. Siddarth Pai, Managing Partner at 3One4 Capital, called it “a huge reform” and “a watershed moment” for the Indian startup ecosystem. He explained that this move is essential for startups to thrive in India and will help them build successful businesses here.

Pai also noted that taxing capital was counterproductive and had been used to harass startups and investors. With the introduction of mandatory dematting of securities and the requirement to disclose unlisted investments in tax returns, the transparency gap that the angel tax was meant to address has been filled. He emphasized that after 12 years, the startup industry can finally breathe a sigh of relief with the removal of this tax.

Background on Angel Tax

The angel tax was first introduced in 2012 to prevent money laundering. It imposed taxes on the funds raised by startups if the valuation was higher than the fair value of shares, as determined by a merchant banker. Over the years, this provision caused problems for both startups and investors, who faced tax issues even with genuine investments.

In 2019, the government made a partial concession by exempting DPIIT-registered startups from angel tax. However, this exemption was limited and only applied to startups certified by the Inter-Ministerial Board (IMB), which left many startups still affected by the tax.

Previous Concerns and Changes

Last year, the removal of a foreign investment exemption in the Finance Bill 2023 raised concerns among startups. Despite this, investments made by SEBI-registered alternative investment funds continued to be exempt from angel tax.

What the New Budget Means

With the abolition of angel tax, all investors, whether domestic or foreign, will now be able to invest in startups without the fear of facing tax issues. This change is expected to boost investment in the Indian startup sector and support its growth.

Reactions to the Announcement

Many in the startup community are celebrating this reform. The move is seen as a crucial step towards fostering a more supportive environment for startups in India.

Key Points

- Angel Tax Abolished: Finance Minister Nirmala Sitharaman announced the end of angel tax for all investors in Budget 2024.

- Impact on Startups: The removal of the tax is a major reform for the Indian startup sector, helping startups stay and grow in India.

- Background of Angel Tax: Introduced in 2012, it taxed funds raised by startups above fair value, causing issues for investors.

- Previous Exemptions: In 2019, a partial exemption was introduced but was limited. Last year’s budget change raised new concerns.

- Future Outlook: The abolition of angel tax is expected to encourage more investments in Indian startups.