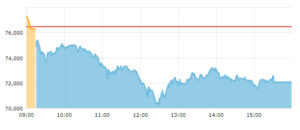

Stock indices witnessed bloodbath on the day the Lok Sabha results are being announced, where incumbent BJP performed below par and seems it may fall short of exit poll predictions and the majority mark on its own.

The idea of a coalition government lead by BJP at the Centre has led to widespread market anxiety and a sharp decline in stock indices.

The failure to secure a clear majority to BJP of its own raises concerns about the formation of a stable government and the continuation of economic reforms.

At the closing bell, Sensex closed at 72,079.05 points, down 4,389.73 points or 5.74 per cent, while Nifty closed at 21,884.50 points, down 1,379.40 points or 5.93 per cent.

The markets on Tuesday experienced significant volatility due to the uncertainty surrounding the election outcomes mainly due to the gap between the exit polls and the actual results declared, with broader indices, Nifty 50 closing the day at -5.93 per cent and the lowest of the day touching -8.19 per cent. “Indian equities plunged er the vote counting trends suggested a lower seat count for the ruling NDA Government,” confirmed Ajay Menon, MD & CEO, Broking & Distribution, Motilal Oswal Financial Services. Menon notes that at one point, Nifty was down almost 2000 points — 9.3 per cent down before recovering a little to finally close at 21884 levels with a loss of 1379 points (5.9 per cent down). “The broader market may turn volatile as sentiments get hit, but a major trend of the Indian equity market is expected to revive after the cooldown of volatility over the next couple of days,” said Menon. Pradeep Gupta, Co-founder & Vice-chairman, Anand Rathi Group, notes that the pre-election rally witnessed on Monday — driven by expectations of a landslide BJP victory — had already been factored into market prices. “Till the question of the continuity of the current government was at an unsure position, the markets continued with heightened volatility in the short term period, says Gupta.

Market players are, however, taking a longer view of the developments, with Gupta citing historical data to suggest that despite initial volatility, markets tend to recover and even thrive in the longer term. “For instance, even after the 2014 and 2019 elections, the Indian stock market saw significant gains in the months following the election results,” adds Gupta. “While the immediate market reaction to the election results has been volatile, the overall long-term outlook remains positive, particularly if policy continuity is maintained,” says Gupta, who expects sectors like infrastructure, defence and capital goods to benefit from policy continuity and government focus on development projects.

Anand Rathi also suggests that large-cap stocks are preferred for their stability and resilience against economic fluctuations. “Investors are encouraged to stay informed, focus on fundamentals, be prepared for short-term fluctuations and focus on long-term strategies, such as maintaining a diversified portfolio and avoiding panic selling. “Strong fundamentals and resilience against political changes are crucial for navigating market volatility,” Gupta observes.

Menon expects the volatility around the outcome to reduce over the next few days and market focus to return on macro and fundamentals which continue to remain strong, but more importantly, as Menon points out, once the new government is formed, it will present its first and full budget for FY25 in the next few weeks, where themes like capex, manufacturing, rural, consumption, and credit lending will be back in focus. “The rural and consumption theme would also pick up pace with the onset and progress of Monsoon, which is predicted to be above normal this year,” indicates Menon, suggesting that even if market volatility continues in the near term.