The recent move of the Insurance Regulatory and Development Authority of India (IRDAI), the insurance regulator, to help senior citizens and those with pre-morbid conditions is expected to make health insurance premiums go up by 10-15%, according to reports quoting experts.

From 1April 2024, IRDA has updated the definitions of the pre-existing condition and moratorium period (MP) in health insurance policies. While the waiting period forpre-existing disease (PED) coverage in health insurance policies has been reduced from four years to a compulsory three years, the moratorium period has beenshortened from 96 to 60 months. Insurance companies enforce a “no look back” policy during this period.

The move comes at a time when consumers are struggling to get their health claims processed. Almost one-third or 1.6 lakh cases out of total 5.5 lakh pendingconsumer complaints received by the department of consumer affairs are of the insurance sector, participants at a roundtable on Consumers and the InsuranceSector, organised last year, were told.

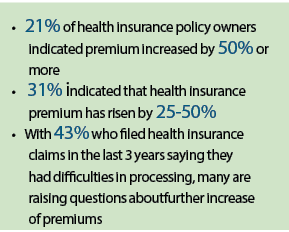

In the latest LocalCircles survey, 43% citizens who filed a health insurance claim in the last three years explicitly indicated that they had difficulty in getting it processed. Complaints ranged from outright rejection to exclusions to deduction and most commonly,delays.

The situation is so bad that in many cases, patients spend 8-12 hours on their last day after being ready for discharge to actually get discharged as theyare waiting on the insurance claim to be processed. Doctors and hospitals owners are a frustrated lot as well as the patient is occupying a room which can beused to admit and treat another waiting patient.

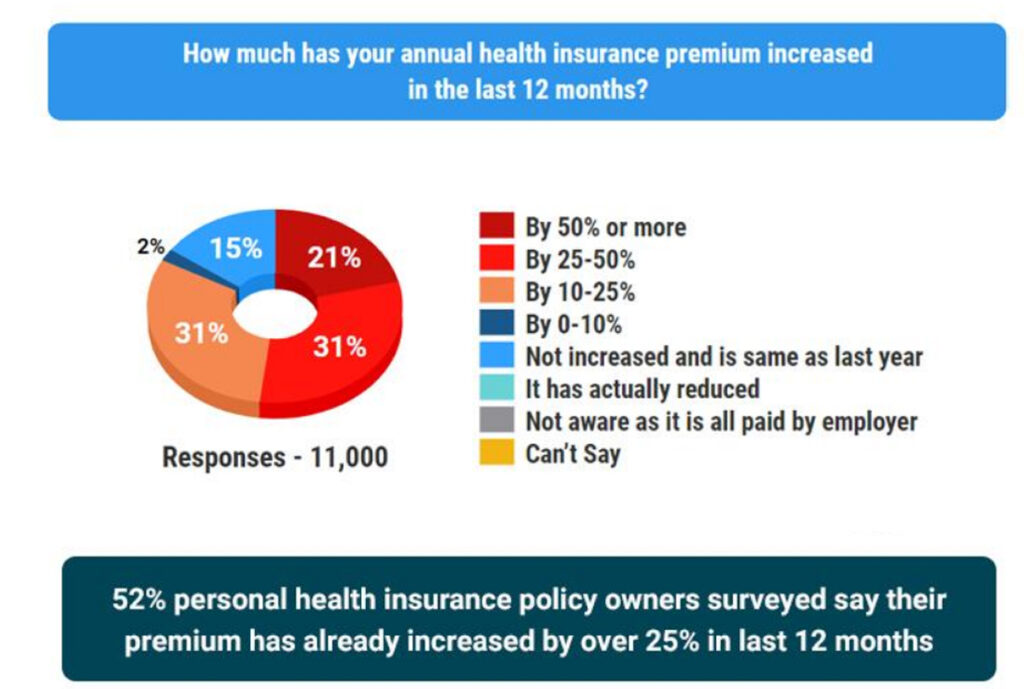

With hundreds of health insurance policy holders raising concerns about rising health insurance premiums, LocalCircles, a community social media platform through a new survey attempted to understand how much their premiums have increased by in the last 12 months.

The survey received over 11,000 responses from personal health insurance policyholders located in 324 districts of India. 67% respondents were men while 33% respondents were women. 39% of respondents were from tier 1 locations, 30%were from tier 2 locations while 31% were from tier 3, 4 and rural locations.

The survey asked owners of personal health insurance policies, “How much has your annual health insurance premium increased in the last 12 months?”

Out ofthe 11,000 health insurance policy owners who responded, 52% indicated that their premium has increased by over 25% in the last 12 months.

In fact, 21% ofhealth insurance policy owners indicated that the increase in premium was 50% or more in the last 12 months while 31% indicated that it has risen by 25-50%. Ofthe remaining respondents, 31% indicated an increase of 10-25%; while 2% indicated 0-10% increase in premium rates; 15% denied any increase in premium

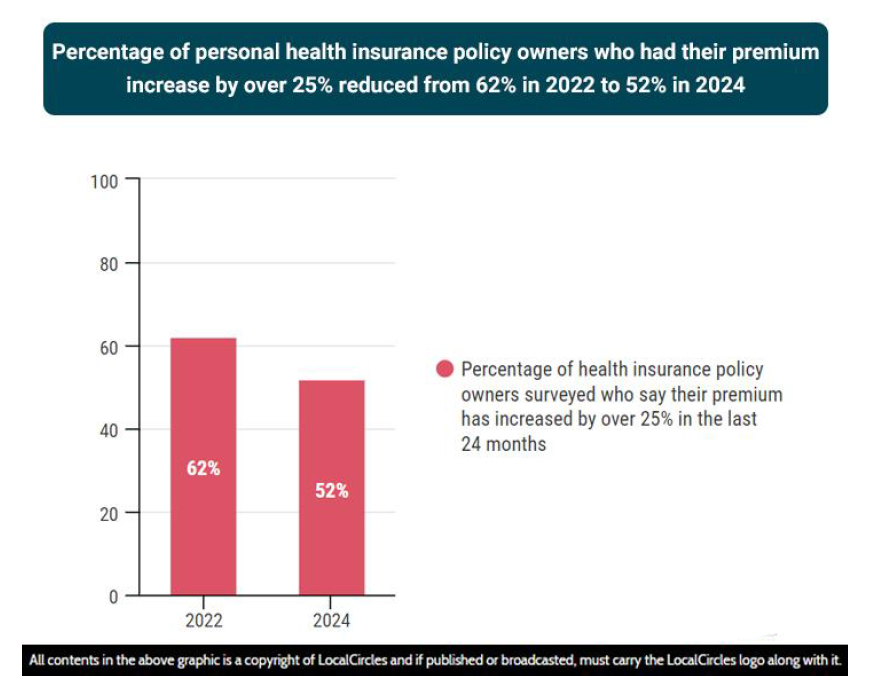

A comparative study with the survey results of 2022 shows that the personal health insurance policy owners who had seen an increase in their premium by over25% has dipped from 62% in 2022 to 52% this year. 2022 was an year marked with heavy increases in health insurance premiums as many insurance companieswere projecting another wave of COVID in 2022-23 and had increased premiums in anticipation.

In summary, personal health insurance policy holders are deeply concerned with a significant rise in premium in 2024 after already experiencing high double digitincreases in the last 2 years. While on the premium front, the insurance companies want a hefty increase each year, the claims processing continues to beinefficient with 1 in 2 who files a health insurance claim struggling. It is time IRDAI steps in to rationalize the increase in premiums along with processing of claimsso health insurance becomes citizen centric.

The study received 11,000 responses health insurance policy holders located in 324 districts of India. 67% respondents were men while 33% respondents w erewomen. 39% of respondents were from tier 1 locations, 30% were from tier 2 locations while 31% were from tier 3, 4 and rural locations. The survey wasconducted via LocalCircles platform, and all participants were validated citizens who had to be registered with LocalCircles to participate in this survey.