Prime Minister Narendra Modi on Monday stressed on the need to increase the economic self-reliance of India in the next 10 years so that the impact of global issues is mitigated.

“Today, India is becoming the engine of global growth with 15 percent share in global GDP growth”, Modi said while praising the RBI for playing a pivotal role in advancing the nation’s growth trajectory.

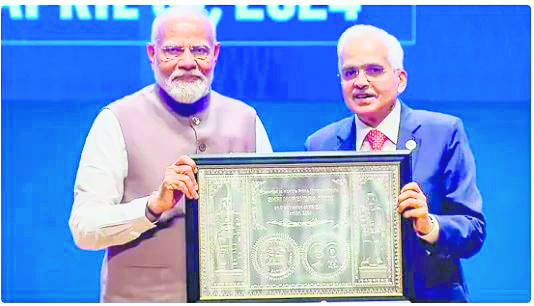

Addressing the opening ceremony of RBI@90, a programme marking 90 years of the Reserve Bank of India, in Mumbai, the PM said the policies drafted today will shape the next decade of RBI and noted that the next 10 years will take RBI to its centenary year.

“The next decade is extremely important for the resolutions of a Viksit Bharat”, PM Modi said, highlighting the RBI’s priority towards fast-paced growth and focus on trust and stability. The Prime Minister also conveyed his best wishes for the fulfilment of its goals and resolutions.

He underlined that the RBI has witnessed both the pre and post-independence eras and it has created an identity around the world based on its professionalism and commitment.

The Prime Minister congratulated all staff on the completion of 90 years of the RBI.

Emphasising the importance of coordination of monetary and fiscal policies in the GDP and the economy of the country, the Prime Minister recalled the 80-year celebration of RBI in 2014 and remembered the challenges and problems like NPA and stability faced by the banking system of the country at that time. He said that starting from there, today we have reached a point where the Indian banking system is being seen as a strong and sustainable banking system of the world as the near moribund banking system of that time is now in profit and showing record credit.

The Prime Minister credited clarity of policy, intentions and decisions for this transformation. “Where intentions are right, results too are correct,” said the Prime Minister.

Speaking on the comprehensive nature of reforms, the Prime Minister stated that the government worked on the strategy of recognition, resolution and recapitalization. A capital infusion of 3.5 lakh crore was undertaken for the helping public sector banks along with many governance-related reforms.

Just the Insolvency and Bankruptcy Code has resolved loans amounting to 3.25 lakh rupees, the Prime Minister pointed out. He also informed the country that more than 27,000 applications involving underlying defaults of more than Rs 9 lakh crore were resolved even before admission under IBC. Gross NPAs of banks that stood at 11.25 percent in 2018 came down to below 3 percent by September 2023. He said that the problem of twin balance sheets is a problem of the past. PM Modi complimented RBI for their contribution to this transformation.

In the last 10 years, the PM said that the government has highlighted the connection between the central banks, banking systems and beneficiaries at the last queue and gave the example of financial inclusion of the poor. He mentioned that 55 percent of the 52 crore Jan Dhan accounts in the country belong to women. He also mentioned the impact of financial inclusion in the agriculture and fisheries sector where more than 7 crore farmers, fishermen and cattle owners have access to PM Kisan Credit Cards providing a significant push to the rural economy.

Referring to the boost for the cooperative sector in the past 10 years, the PM threw light on the importance of regulations of the Reserve Bank of India regarding cooperative banks. He also mentioned more than 1,200 crore monthly transactions via UPI making it a globally recognised platform. The Prime Minister also touched upon the work being done on Central Bank Digital Currency and said that the transformations of the past 10 years have enabled the creation of a new banking system, economy and currency experience.