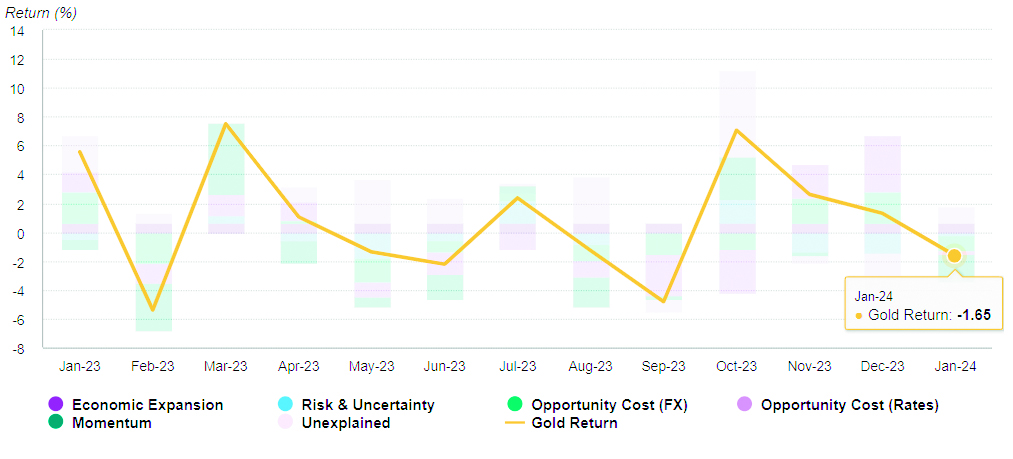

Gold prices experienced a decline, retreating to US$2,053/oz, marking a 1% decrease for the month and deviating from the usual historical seasonal strength. A pullback after the strong year-end performance seemed likely.

The Gold Return Attribution Model (GRAM) attributes this retracement to the acceleration of outflows from global gold ETFs (Exchange-traded Funds) amounting to 51 tonnes and a reduction in net longs in COMEX futures by -206 tonnes.

Additionally, the surge in US economic strength, which exceeded expectations, and the absence of anticipated early monetary policy cuts contributed to headwinds, including higher Treasury yields and a stronger US dollar.

Initial reduction and its impact

The initial reduction doesn’t always have the most significant impact. Despite protests from certain Federal Reserve members and a couple of robust data releases, expectations for a March Fed rate cut seem to have diminished, especially with a more hawkish European Central Bank (ECB) stance.

While declining rates, particularly at the longer end of the curve, generally favour gold, historical patterns suggest that the first Fed cut after a series of hikes tends to lack substantial immediate impact. Notable rallies typically occur if there is a notable economic or equity correction, leading to lower longer-term yields. This tendency holds, especially if the cut is widely anticipated or accompanied by a soft-landing narrative. Historically, recessions haven’t promptly manifested after the initial cut, if they materialize at all.